Revenue forecasting is used to determine the projected revenue a contractor will receive for completing a project or scope of work. The amount of revenue earned compared to the total cost spent determines how much profit and % margin is made. Therefore, understanding projected revenue is critical to determine the profitability and health of a project.

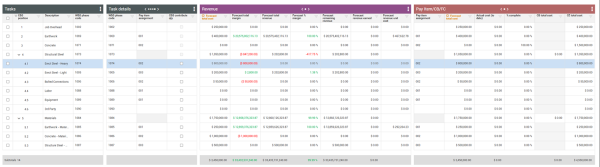

It is often necessary to compare forecasted cost to expected revenue at a cost item level. Within Control, you can view this comparison using the revenue columns available in the CBS. The revenue fields in the CBS auto calculate based on the billing method of each line item or can be overridden by manually entering a revenue forecast.

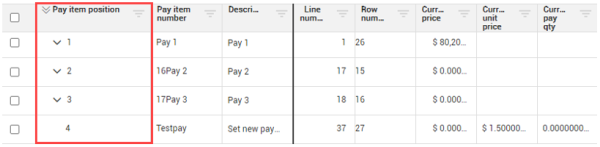

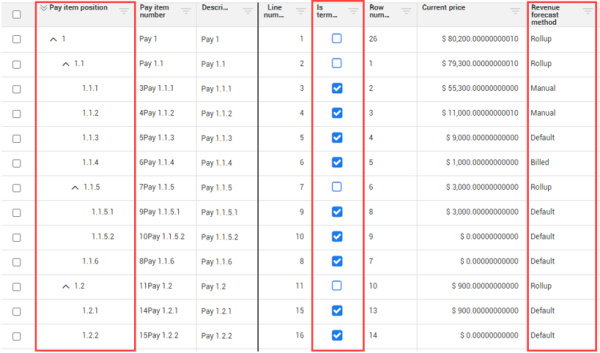

Pay Item Position Code Column

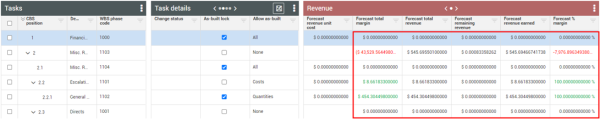

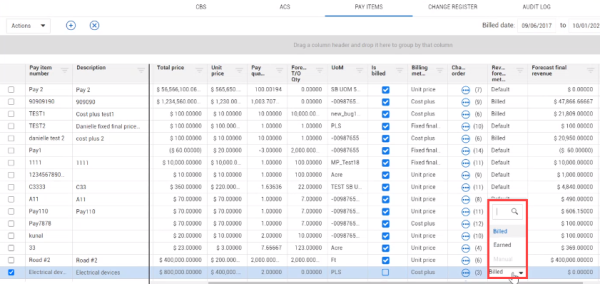

The Pay Item tab contains a Pay Item Position column that lets you view, sort, and group pay items in a hierarchical manner much like you can in the CBS. This feature lets you expand and collapse pay items by clicking the down-arrow, while also letting you group scopes of work together into a hierarchy.

Adjusting the pay item position code column lets you see the parent-child rollup relationship between pay items, terminal pay items, and the revenue forecast method, in addition to any other price and revenue columns. This lets you see how the values for the child pay items all roll up to its parent pay item, then see the totals at a parent pay item level.

|

Columns |

Register |

Description |

|---|---|---|

|

Forecast total revenue |

CBS and Pay Items |

This is your expected final revenue at completion. The calculations vary by assigned billing method. This value is based on the Pay item’s final revenue * a percentage that can be earned by the cost item. |

|

Forecast total cost |

CBS and Pay Items |

Total cost (to date) + Forecast remaining cost. |

|

Revenue forecast method |

Pay Items |

For Fixed Final Price, you can select Default and Manual. For Cost Plus, you can select from Earned, Billed, and Manual. The roll-up revenue forecast method is automatically assigned for parent pay items, and not editable, as all forecast revenue for child pay items rolls up to the parent pay item. |

|

Billed revenue |

Pay Items |

Amount billed to the client for a single pay item. |

|

Fixed final price |

Pay Items |

Lump sum billing method (price agreed upon by a contractor and a client does not change without a contract order). |

|

Forecast % margin |

CBS and Pay Items |

Forecast final margin / forecast final revenue. |

|

Forecast total margin |

CBS and Pay Items |

Forecast final revenue – Forecast final cost. This is the total profit you’re forecasting to make at completion of the job. |

|

Forecast remaining revenue |

CBS |

Forecast final revenue – Forecast revenue earned, revenue remaining to earn. |

|

Forecast revenue unit cost |

CBS and Pay Items |

Forecast final revenue / Forecast take-off quantity, amount of revenue earned per quantity. |

|

Forecast revenue earned |

CBS |

% complete * Forecast final revenue. This is revenue that is earned based on completion of work. |

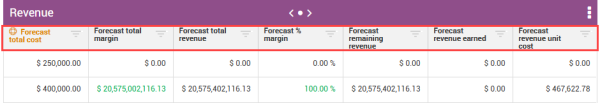

CBS Register

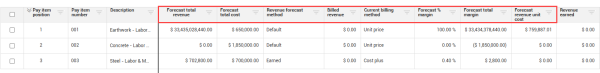

Pay Item Register

Cost Item Revenue View

It’s important to see forecasted cost and forecasted revenue side by side, in order to compare the costs and revenue on individual cost items as a subtotal of the overall project.

In Control, you can create a custom revenue data block containing six revenue-related columns. Permissions can be established to limit who may view these Revenue columns. You can view this data block within the same view as a forecasted costs data block for a side-by-side comparison.

The Revenue columns can only be populated if the associated cost items have an assigned pay item. In the example below, cost item 1 Job Overhead, does not have a corresponding pay item assignment, therefore the Revenue columns are not populated. The opposite is true for Cost item 2 which has a corresponding pay item assignment.

Cost item revenue calculation by allows as-built

For parent cost items where the allow as-built is not equal to None, where cost or quantities are being tracked, revenue values are now being calculated at the parent cost item level rather than always rolling up children revenue values to the parent. If the costs or quantities are being tracked at the terminal cost items, then those revenue values are calculated at the terminal cost items and roll up to the parent.

Revenue Columns

There are Revenue Forecasting columns that exist in both the CBS and Pay Item registers.

Cost Plus Revenue Forecast Methods

Another phrase for the billing method for Cost plus is Time and Material or Time and Expenses. Instead of having a contractual agreement of being paid a certain lump sum, you are reimbursed for your time, labor, and equipment hours and any materials that you purchased as well. With Cost plus, a markup value is typically included. You submit time cards each week to get paid for your labor hours, equipment hours, and any materials or supplies that you purchased plus any markup value that had been agreed upon.

The Cost plus Revenue Forecast Methods are only applicable to pay items that have a billing method of Cost plus. These forecast methods include:

- Billed

- Earned

- Manual

Billed Revenue Forecast Method is all of your forecast remaining revenue that is driven off your cost items. Meaning this method's calculation is the following: 1 - % complete x Work Hours x Billing Rate. This gives you your Forecast Remaining revenue which is your Remaining revenue you need to earn on the cost item. For the pay item, the revenue sums up all of those remaining revenues at the cost item level. It then adds anything that has been billed which is the Remaining revenue at the cost item level plus any revenue that has been billed to the pay item.

Earned Revenue Forecast Method is similar to the Billed Revenue except it uses the Forecast remaining revenue. The Earned Revenue calculation is your forecast remaining revenue at the cost item level summed up for all the cost items assigned to that pay item plus your earned revenue. The earned revenue is also driven by the cost items. To summarize, it is the forecast remaining revenue plus anything that you earned. This is also the calculation for your percent complete as well.

Manual Revenue Forecast Method manually forecasts your final revenue on that pay item with you entering in a value.

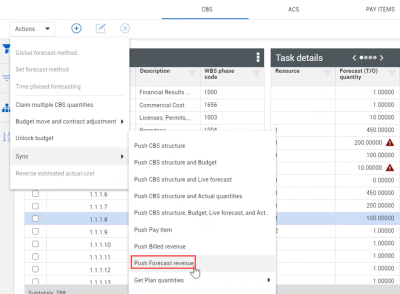

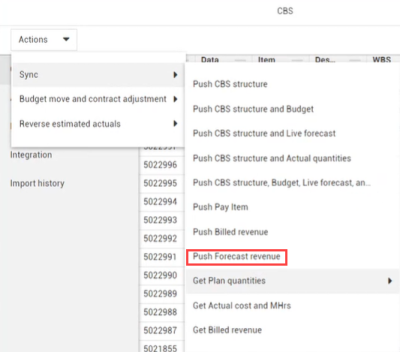

Forecast Revenue Sync

The forecast revenue sync pushes all of your revenue details from the Pay Items tab to an ERP system. You can start this sync from the Control Actions drop-down menu.

Revenue Snapshots

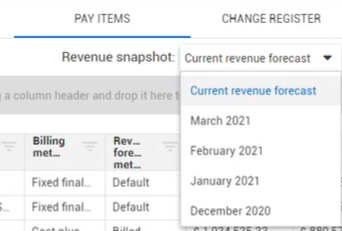

Revenue snapshots capture pay item information and cost item revenue information using the sync Push Forecast revenue. When a project forecast revenue is pushed, it generates a revenue snapshot.

When the project month rolls over, the last push revenue forecast sync before month-end is recorded. If a sync has not run during the month, then the system automatically takes the revenue forecast snapshot based on the date and time.

After the revenue snapshot has been recorded, you can look at past snapshots to view previous values. For example, in the pay items register you can view current and previous Revenue snapshots using the Revenue snapshots in the drop-down menu.

If you view a past snapshot, the data that loads is read-only. You cannot edit any of the fields.

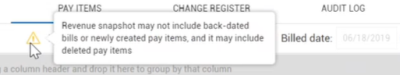

The billed date shows the earliest build of the project when the snapshot was taken and includes any pay items in the pay item register. The snapshot might not include back-dated bills or newly created pay items. The snapshot might include deleted pay items.

For example, February has ended and the snapshot was taken it is now March and you backdated a bill, such as billed revenue or billed quantity into February. The backdated bill is not included in February's snapshot because the snapshot had already been taken.

The snapshot is automatically recorded by month and year. Whenever the month ends, the monthly Revenue snapshot shows in the revenue snapshot drop-down list.

The snapshot records the revenue columns for pay items. The columns are the following:

-

Forecast final revenue

-

Forecast remaining revenue

-

Forecast revenue earned

-

Forecast unit revenue

-

Percent margin

-

Forecast final margin

The snapshot records the information automatically based on your fiscal calendar settings.